Part 1: A New Donor Study in Near-Real Time

Given the dramatic increase in new donors this year, we recognized the need to learn — and learn quickly — who these supporters are. We set out to determine whether, and how, they differ from previous public media supporters. Working with data from the Members Services Bureau fundraising co-op, we performed an in-depth demographic analysis of 180,000 new donors acquired since January 1, 2025. This was completed in time to think about engagement strategies now and retention efforts for 2026 and beyond.

Here’s what we learned.

Meeting the Moment — Younger Donors Step Up

Public media experienced unprecedented new donor growth in 2025, particularly during periods of increased attention on federal funding. The year-to-date increase through August in new donors was 61% compared to the same period in 2024.

After several years of flat or declining new donor counts, we wanted to find out more about these new donors. And boy, did we ever.

Using a group of 45 public media organizations across all sizes and licensee types, we performed a demographic analysis on the 180,000 new donors acquired between January 1 and August 30, 2025.

Jumping right to the chase, millennials are on the rise and on the move.

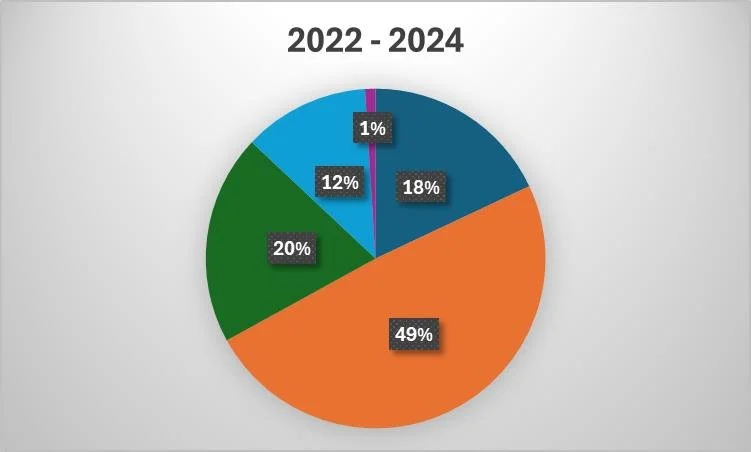

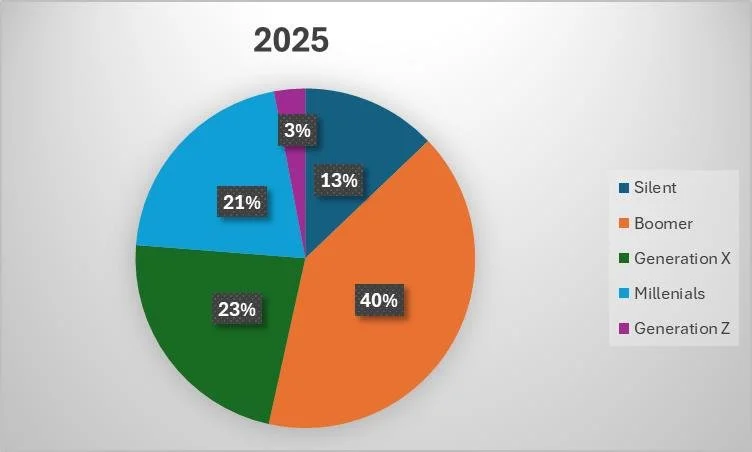

Boomers and Silents continue to make up the greatest share of new donors in 2025, but their slice of the pie is declining from two-thirds in previous years to just over half in 2025. Gen X, millennials and Gen Z are all on the rise. The percentage of new donors that were younger than 45 (millennials and Gen Z) nearly doubled from 13% in prior years to 24% in 2025.

New Donors by Generation

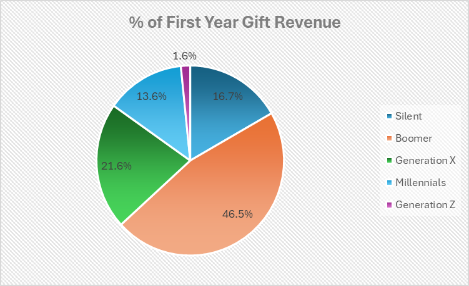

While boomers made up 41% of new donors to public media in CY25 (Jan-Aug), their first gift amounts represent 46% of all first-year revenue.

This, of course, is most likely related to income and life stages. Focusing on the youngest donors coming into the donor files, here is a breakout by income.

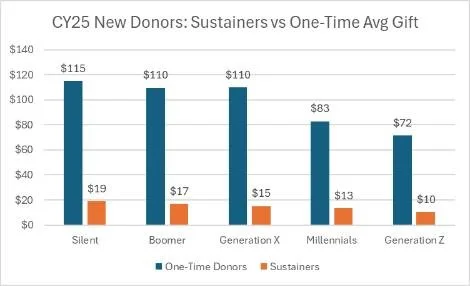

It is not surprising to see smaller average gift sizes for one-time and sustainer gifts for our new millennial and Gen Z donors. These generations have yet to reach their top earning potential and are likely in the thick of student loans, mortgages and childcare expenses.

Note that one-time gifts from Gen X are in line with their boomer siblings. Gen X donors are now between 45 and 60, with many in or heading toward their prime giving years. How does this inform your interactions with this generation?

And those millennials are on the move. Two-thirds of our new millennial donors have been in their current residence for less than three years. Are they recent transplants to your area? New home buyers? All things to consider for potential events and current giving potential.

Visit us for Part Two of this series where we will look at more ways to engage these donors and how they are giving to their local public media organizations.

Methodology:

Our new donor dataset for calendar year 2025 included 180,000 donors across 50 public media stations (21 TV, 20 Joint, 9 Radio) making their first donation in the first eight months of 2025. These accounts were matched to consumer demographic characteristics, including wealth and income characteristics, to gain insight into new donor behavior and profiles. Additionally, a dataset of nearly 1 million first-year donors to 57 public media stations (24 TV, 22 Joint and 11 Radio) across five years of historical giving data (2020-2024) provided the basis for our historical analysis of first-year donor demographic profiles and first-year giving channel trends. These combined datasets represent the largest single source of new donor giving to public media and offer a diverse and discerning lens into this generous and evolving base of donors offering their financial support to this critical sector.